Capital Appreciation (JSE: CTA): What’s not there to appreciate ?

Multi-baggers are stocks that have managed or are positioned to deliver more than 100% returns in the coming years.

Unlike in the US where multi-baggers are a norm, slow earnings growth together with a difficult macro-economic environment has resulted in few multi-baggers on the local market. Towards the top of a bull market we often come across articles highlighting how much we could have made had we invested R10 000 into a multibagger stock, be it Capitec, Clicks, Shoprite, Afrimat, Karoooo, Transaction Capital etc…

Obviously, with the benefit of hindsight, it is easy to pinpoint where the rabbit was instead of where the rabbit will be.

As a quality growth-focused house, we at Effectus Capital spend our time hunting for compounding machines and without the benefit of hindsight, this article will take you through reasons why we believe Capital Appreciation is set to be a multibagger over the coming years.

What is it that we love about Capital Appreciation?

- High sales growth

- Robust and Improving margins

- Strong and a resilient balance sheet backed by intelligent management

- Room for valuation multiple expansion

- Innovative management which embraces technology with hunger to disrupt

About Capital Appreciation

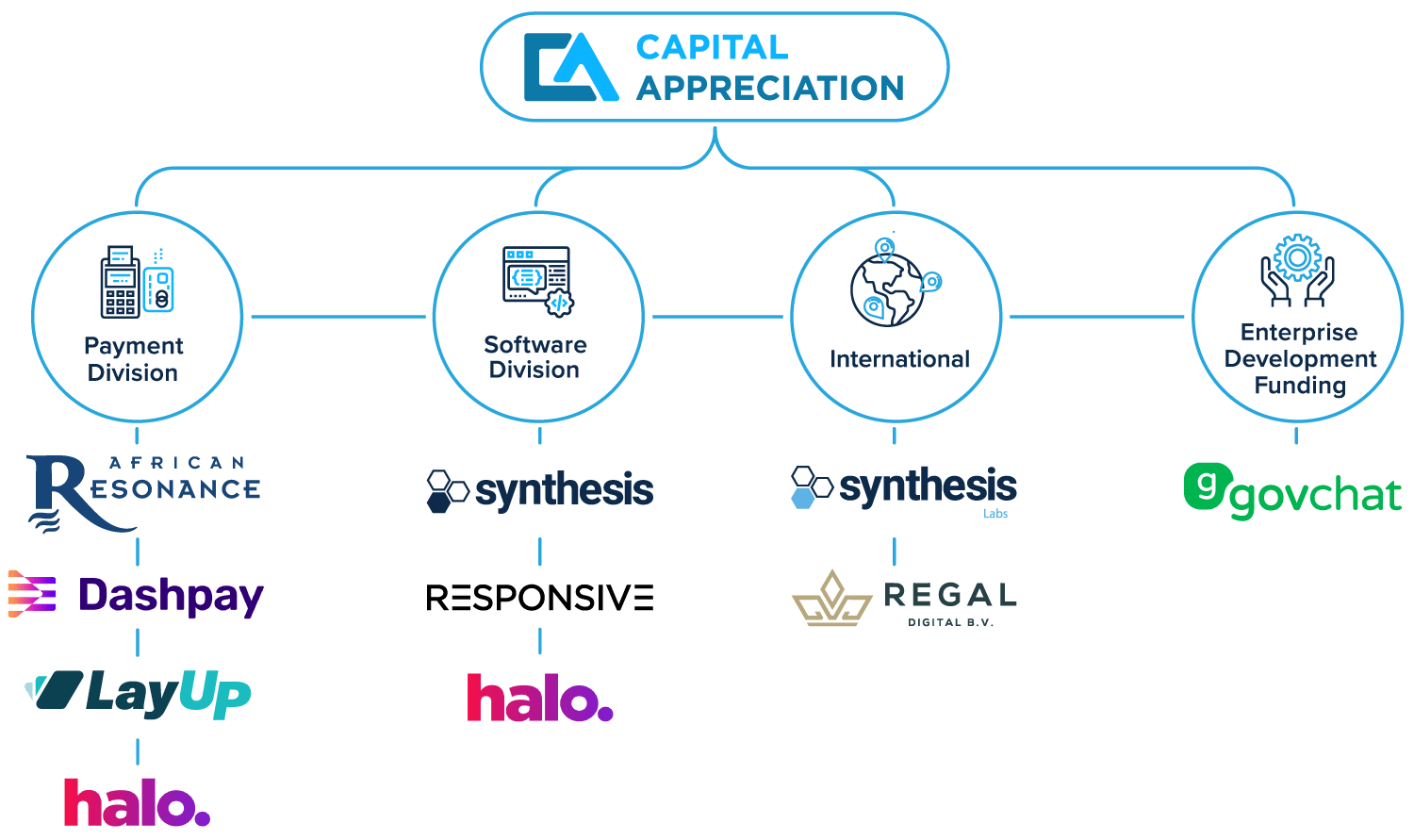

Capital Appreciation (CTA) is a JSE listed fintech business, the company has a market capitalization of R2.3 billion. Its operations spans from payments infrastructure, payments system technology and software services

Software services:

Synthesis software services is a subsidiary of Capital Appreciation; it offers a wide range of services in software development,consulting, and integration services to banking and other financial institutions. Synthesis product solutions include online banking and regulatory reporting solutions (SARS and SARB). Synthesis is also an accredited AWS Consulting Partner, it assists it’s clients in becoming “cloud ready”, to execute mass migrations

Payments:

The payment business provides payment infrastructure (mainly point-of-sale devices) and other payment-related technology solutions to established and emerging financial institutions, hospitality service providers together with retail operators. Its technology

solutions enable business-to-business payment-related products and its platform services are well-suited for secure digital payments systems.

The Payments business is the largest division at 64% of sales, the division has proved to be more cyclical than the Software services business, Payment’s business growth has lagged that of the Software Services which continues to enjoy strong secular tail

winds with revenues consistently compounding at over 25% per year over the past 5 years.

ECM seeks to invest into high growth industries

Our philosophy at Effectus Capital is to look for businesses with the ability to sustain superior cashflows growth with strong balance sheet and competent management, all these in a high-growth industry.

Capital Appreciation is an excellent example of the kind of business that ECM seeks to own over a long period of time in order to harvest the full force of compounding. Capital Appreciation’s two business divisions are strategically positioned into high-growth industries, furthermore, Covid-19 has accelerated trends toward contactless payments systems as well as cloud adoption.

Let’s delve deeper…

High Sales growth

At first glance, Capital appreciation looks like a normal S.A based small cap stock struggling to find a source for sustainable growth with revenues having compounded at only 9% p.a over the past 5 years, but when you look deep into the numbers, you soon realize “there is more than meets the eye”.

The Payment Market

The global payments market continues to grow at double-digit rates, the digital payments market is expected to deliver 10% CAGR from 2021 to 2027. Demand for greater convenience associated with frictionless payment systems, favorable government policies, and evolving consumer behavior as well as covid-19 related disruptions are set to accelerate the adoption of digital payments

Contactless Payments

Adoption for contactless payment systems accelerated during covid-19 due to several forces at play: Covid-related lockdowns: Ecommerce sales boomed as people where transacting online eliminating the need for cash payments Covid-19 is highly contagious: physical cash seemed like a dangerous way for doing business as it could easily transmit covid-19 from one person to another.

Furthermore, the continuous evolution of payment systems has paved a way for superior industry growth for years to come. Capital Appreciation is positioned to benefit from this growth

How is Capital Appreciation positioned in the payment space?

Through its partnership with a leading manufacturer of payments devices Ingenico, Capital Appreciation has been growing its terminal estate as the chart below shows. What this means is that in its positioning, Capital Appreciation has been deploying more terminals into client hands. The total number of terminals in clients’ hands has compounded at over 24% p.a. reflecting strong demand for its terminals. Even more pleasing is to see % active accelerating from 65% in 2017 to 79% in 2022 reflecting the increased utility of the terminals

At 59% of total segment sales, terminal sales are still the biggest driver of sales for this division, but importantly we see this changing over time. The growing terminal estate will lead to an acceleration in maintenance & support revenues together with transaction income and reduce the reliance on new sales for growth.

Maintenance and support revenues are more recurring in nature which makes them more predictable than those from sale of terminals

The Cloud Computing Market

The global cloud computing market has been exploding for a number of years and the overall market is set to multiply by over 3 times growing at 15,7% from 2022 till 2030.

Pre-covid, cloud computing was already one of the fastest growing industries enjoying several tailwinds including:

Rapid digitization of the economy

Operational efficiency and reliability of the cloud

Through Synthesis Software, Capital Appreciation has positioned itself as the preferred consulting partner for Amazon Web Services (AWS). This is a massive competitive advantage as AWS is a leading cloud provider globally with 33% market share.

Synthesis is Set to Maintain its Growth Trajectory

Synthesis has received multiple awards amongst others, it is the first Advanced Consulting partner for Amazon Web Services in Middle East and Africa.

The business continues to add new AWS accreditation solidifying its market-leading position. Recent expansion into Netherlands and Singapore will see Synthesis accelerate its growth trajectory.

Over the medium term, we expect international revenues to gain traction, but services and consultation fees will remain the largest contributor to sales

Improving Margins

After a drop in 2018, Capital Appreciation group margins have increased from 23% in 2019 to 25% in 2022. This margin expansion was due to the extraction of operational efficiencies in the payments business. We expect overall group margins to remain relatively below average segmental margins due to costs associated with head office.

Our view is that the two segments already have attractive operating margins at mid-20’s and we expect the Payments segment to continue extracting incremental efficiencies whilst Software service margins are expected to stabilize and revert higher when international operations gain traction

Strong and resilient balance sheet backed by intelligent management

Capital Appreciation currently sits with over half a billion rand in net cash which is 22% of its market value. The management has indicated that CTA has been on the hunt for sizable acquisitions to reduce the cash drag on return metrics.

Pleasingly, management has displayed a high level of discipline and patience when deploying this capital by refraining from overpaying and doing deals just to get something done.

During a recent results announcement, the management highlighted that the business is in a position to do an acquisition of up to R2bn in size. Our view is that; there is no question on the management ability to execute, they are disciplined in capital allocation and innovative in their thinking

Recent acquisitions give a sense of the future direction of the business

LayUp which is a digital lay-by solutions provider has seen more than 5x increase in monthly transaction value, The business was acquired last year.

Responsive is also one of the recently acquired businesses, it is focused on design thinking to improve user experience. Despite being small, the company already services blue chip clients such as Capitec, Nedbank and Old mutual

The recent acquisitions together with Synthesis international expansions provide optionality to the business and early feedback has been encouraging

Room for valuation multiple expansion

Capital Appreciation currently trades slightly above its 5-year historic EV/EBIT ratio on the back of strong share price performance post covid-19.

We believe that CTA precents good value for an investor looking for sustainable growth beyond 3 years and who is looking to grab a multi-bagger. We believe the fair value for Capital Appreciation is approximately 30-40% higher, A growth premium is warranted for a business growing at this rate on the JSE, with such a cash flux balance sheet and optionality and it is not unusual for a stock consistently

growing in the mid-20’s year on year to trade at 17-20 times p/e.

Conclusion

CTA has a good growth profile, strong and capable management with well-demonstrated execution capacity, robust balance sheet and is currently trading with 22% of its market value in cash. The icing on the cake is the fact that the management remains innovation savvy which will position the business for its next phase of growth through accelerated market penetration and new growth levers.

Admittedly, one challenge with the stock is the liquidity of its shares which often keeps institutional investors on the sidelines, this also provides an opportunity for smaller boutique managers.

0 comments